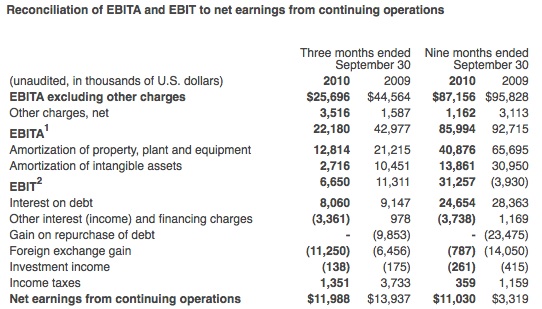

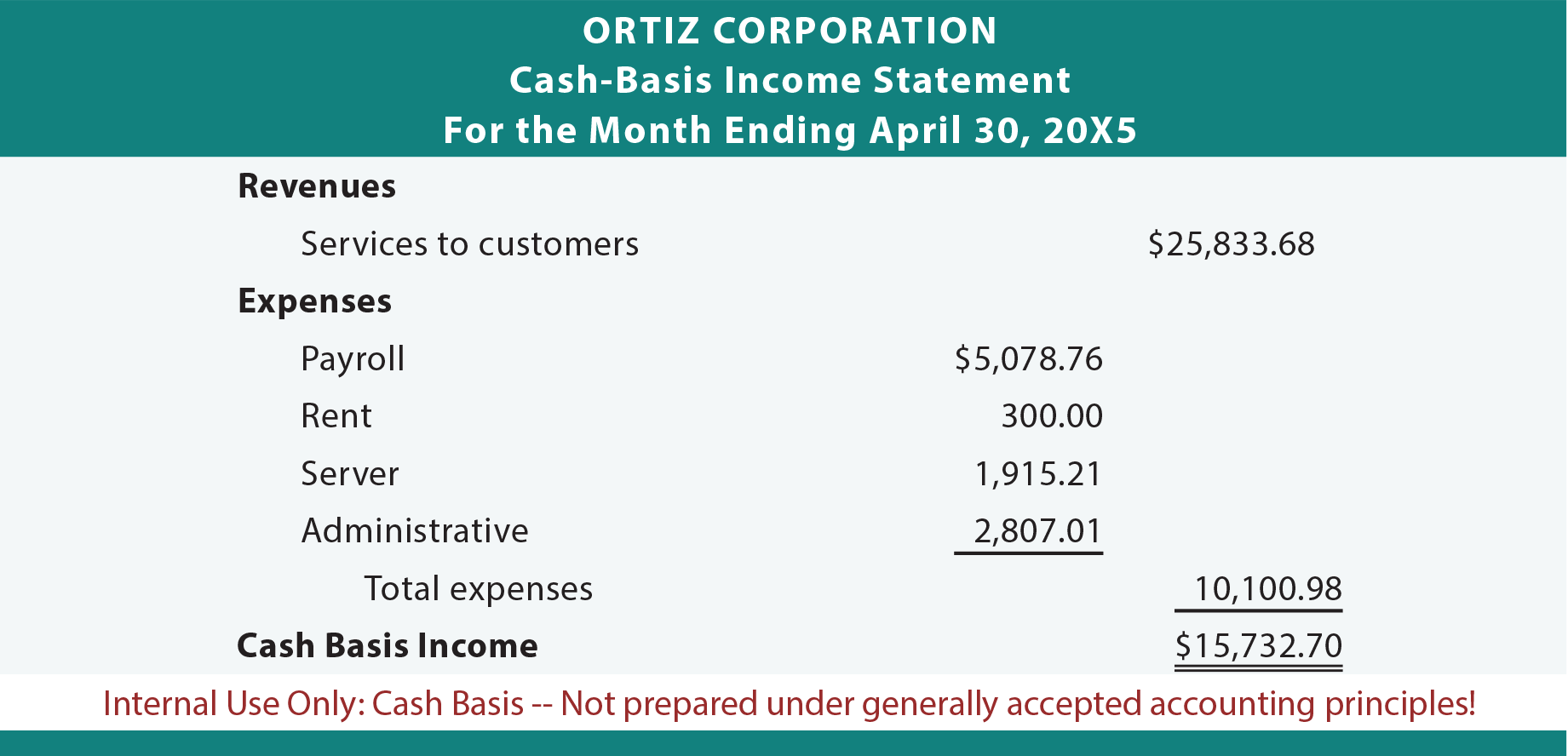

The Ten Generally Accepted Accounting Principles ( GAAP) The origins of GAAP or Generally Accepted Accounting Principles go all the way back to 1929 and the stock market crash that caused the Great Depression. Accounting principles are the rules and guidelines that companies must follow when reporting financial data. accounting principles is the generally accepted accounting. There are notable differences between managerial accounting and financial accounting. Emphasis on the financial consequences of the past activities, mandatory external report and precision are only some of the elements financial accounting has different than the managerial accounting. Generally accepted accounting principles, or GAAP, are a set of rules that encompass the details, complexities, and legalities of business and corporate accounting. Definition of GAAP: Generally Accepted Accounting Principles. A widely accepted set of rules, conventions, standards, and procedures for reporting The Financial Accounting Standards Board (FASB) is a private, nonprofit organization standard setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest. The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting. GAAP is an acronym for Generally Accepted Accounting Principles. These principles constitute preferred accounting treatment. Generally Accepted Accounting Principles (GAAP or U. GAAP) is the accounting standard adopted by the U. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U. GAAP to the International Financial Reporting Standards (IFRS), the latter differ considerably from GAAP and progress has been slow and uncertain. Authoritative rules, practices, and conventions meant to provide both broad guidelines and detailed procedures for preparing financial statements and handling specific accounting situations. Generally accepted accounting principles (GAAP) provide objective standards for judging and comparing financial data and its presentation, and limit the directors' freedom in showing an unrealistic. Basic Accounting Principles and Guidelines. Since GAAP is founded on the basic accounting principles and guidelines, we can better understand GAAP if we understand those accounting principles. GAAP is short for Generally Accepted Accounting Principles. GAAP is a cluster of accounting standards and common industry usage that have been developed over many years. It is used by organizations to: Properly organize their financial information into accounting. GAAP is the acronym for generally accepted accounting principles. that means the basic accounting principles and guidelines such as the cost principle, matching principle, full disclosure, etc. , the detailed standards and other rules issued by the Financial Accounting Standards Board. GAAP (generally accepted accounting principles) is a collection of commonlyfollowed accounting rules and standards for financial reporting. GAAP specifications include definitions of concepts and principles, as well as industryspecific rules. Basic principles of accounting. Developed by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB), GAAP creates a. Generally Accepted Accounting Principles in the United States GAAP is a common set of accounting principles, standards and procedures that companies must follow when they compile their financial statements. Financial Accounting IFRS Principles 4e is an accessible textbook which assumes a basic knowledge of financial accounting, and then helps readers understand and apply the accounting standards collectively known as International Financial Reporting Standards (IFRS). If you have ever inquired about an accounting position at a business, you've probably seen the phrase candidates are required to demonstrate a current knowledge of Generally Accepted Accounting Principles (GAAP). Financial Reporting Taxonomy (Taxonomy) contains updates for accounting standards and other improvements since the 2016 Taxonomy as used by issuers filing with the U. Securities and Exchange Commission (SEC). Life insurance and annuities are issued and employee benefit plans are insured by Symetra Life Insurance Company, 777 108th Avenue NE, Suite 1200, Bellevue, WA, and are not available in all U. The most practical, authoritative guide to GAAP. Wiley GAAP 2018 contains complete coverage of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (Codification), the source of authoritative generally accepted accounting principles (GAAP). Wiley GAAP renders GAAP more understandable and accessible for research and has been designed to reduce the. Equity Method: Accounting Principles Board (APB) Opinion No. The Equity Method of Accounting for Investments in Common Stock b. Issued in March 1971 Investments in.